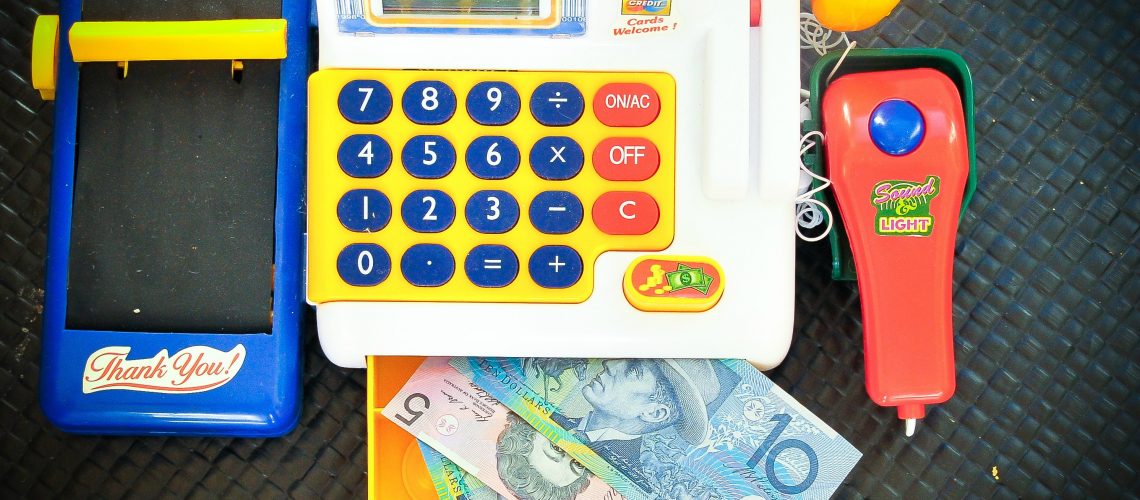

Recently it has come to my attention that my children are starting to cost a lot of money! Well as a matter of fact that came to my attention a long time ago, however as they get older and their tastes and interests mature, there is certainly a feeling of constantly putting ones hand in ones pocket. After being asked one too many times for a slurpee this summer I thought it might be a good idea to give them a set amount of money and see how they can budget it for the summer! Or maybe we should we just give pocket money and see how they go budgeting or saving for bigger items over a longer period of time? We havn’t really done the pocket money thing yet so I started to look in to some of the ways other parents help to teach their kids about budgeting, spending and saving. I imagine there will be some that will cope much better with budgeting than others, but it is something we should be thinking more about as they head into teenage years. Pocket money however shouldn’t be in return for everyday chores that you expect of your children. Being part of a family unit requires that certain jobs are to be done just as part of your contribution to the household. Depending on their ages, kids can be made to make beds, put away toys, unpack dishwashers, take out bins, feed pets etc. I think it is important for kids to know there are certain jobs that are required to be done without reward. I then relate this to my kids by highlighting all the unpaid work I do around the home! I think it is ok though to offer extra pocket money for chores that go beyond their usual so that they do get a sense of reward for effort as well. These may be things like washing cars, mowing lawns etc. When kids get pocket money or money for birthdays I love Michael Grose’ idea of having 3 jars. One for saving, one for spending and one for a charity. I think this gives a great understanding of the need to budget for different things and also a nice lesson in sharing wealth. As kids get older and they start liking designer clothes and expensive basketball shoes then I know many parents that give them the money for the basic version and anything they want beyond that must be saved and paid for themselves. Another good way to differentiate between need and want! For my kids, we have been putting half of their money into a bank account so they are able to contribute to bigger purchases. There are lots of great kids saving plans around such as this one from Newcastle Permanent. This particular savings account comes with a passbook so kids can get the thrill of watching their savings grow, and there are no transaction or account keeping fees. Certainly as they get older and start wanting cars and heaven forbid a house one day, teaching them some skills about money are certainly some lessons that won’t go astray. How do you do pocket money and kids spending at your house? Are their differences in the way your kids spend and save. This is a sponsored post from Newcastle Permanent, for all your personal, business and investment banking.

This Post Has 7 Comments

Money automatically goes out of our bank accounts for each of our three kids and I have to say they have quite big nest eggs right now! But as they grow I want to teach them the value of money, by earning it!

Happy New Year’s Eve Martine 🙂

You and I have similar thoughts Martine about family responsibility and earning wealth. We fought last year we would roll out pocket money, but it just never happened. I would really like to do it this year, but need to start thinking about the best way to do it.

Yes, the main thing is for them to value the money isn’t it? I’m still working out the best way to pass this on, so it’s a good balance between wanting and needing things.

Timely post with all the Christmas gifts of money from relatives who don’t know what gifts to buy. Thanks Martine x

I like the three jar idea, a good thing to start with the ‘icecream’ money they get from the grandparents. They both have good bank accounts, and have more money than me on a good day.

I have been thinking recently about pocket money as our daughter is always asking for things. We have a bank account for her and I think we will go the way of the three jars. And she will get pocket money for doing the chores above and beyond.

We have a chores list, the have the choice to earn money or they can receive a surprise at the end of the week. We find this sets them up for real life experiences. Also whenever my partner has any loose change he gets the children to count it before going into the family money box.

I personally learned how to do budgeting, and quite possibly, looking for ways to get freebies from the days where my parents gave me pocket money (weekly). At first I always find a need to ask them for more, but eventually, I learned how to fit my budget to last the week and still have more for savings to buy the things I love (cassette tapes back then). I believe it still works in today’s kids, but personally I think we need to start them early as kids grow up faster these days. Their needs and wants, and prices tend to grow up fast as well.

Comments are closed.